FEMA Flood Risk 2.0

A bipartisan effort among members of the Hosue and Senate is afoot

to delay the enactment of the new floor premiums.

Click here for more information.

RENEW YOUR EXISTING FLOOD POLICY

(or buy a flood policy if you don’t already have one)

BEFORE OCTOBER 1ST!!!!!!!

Flood Risk Rating 2.0: What is it, why the change, and how will it affect you?

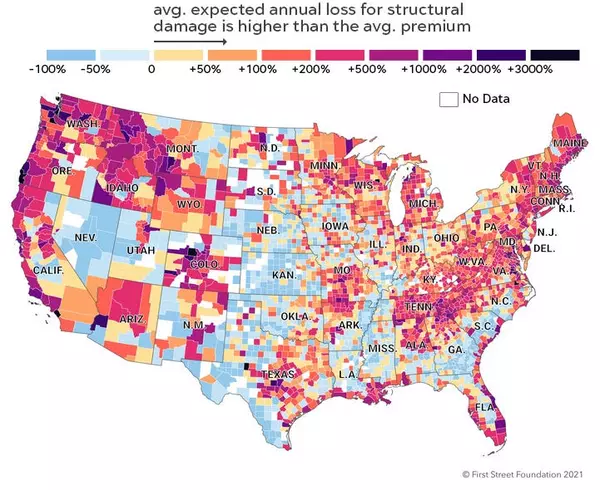

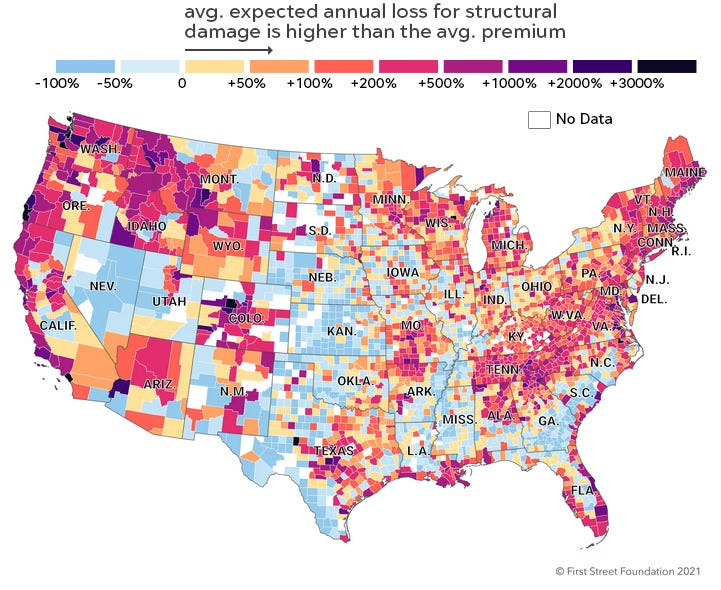

On October 1, 2021 FEMA’s new Risk Rating 2.0 system will go into effect and change the price of flood insurance premiums nationwide. The Risk Rating 2.0 system will no longer use flood zones or BFE’s to determine premiums, but rather take into account individual property elevations, overall flooding risk from various factors, and individual rebuilding costs to offer (in theory) more accurate and fair flood insurance premiums. The goal is that this more comprehensive risk rating system will create more equitable flood insurance rates and make the National Flood Insurance Program more sustainable.

The good news is that if you have an existing policy in place, and your new rate goes up, you will not see an immediate increase until your renewal date and it will not go up more than 18% annually. There are also some properties that may see a decrease in their flood insurance rate! The bad news is that if there is no existing flood insurance policy on the property, you would be quoted based on the full price of the new rating system starting October 1st. The more complicated news is that insurance agents are still trying to navigate the Risk 2.0 system and only last week got access to start running these new flood insurance quotes. I know - this is a lot to digest when we are all dealing with Ida recovery already!!! But it is important that you make sure that you have flood insurance in place before October 1st, especially since hurricane season is not over yet. If you have property in an X flood zone where your lender did not require you to have a flood policy or you own a property outright and chose not to get flood insurance - I strongly recommend that you buy a policy now if you don’t have one already!! If you are in an X zone and pay for your policy outside of your monthly mortgage payment, check that you have paid and renewed your existing policy! If you are in an AE flood zone and have a mortgage in place, your mortgage holder would pay for your flood premium renewal automatically - but check your escrow account to make sure! Ultimately, we will all be checking with our insurance agents to see what our Risk 2.0 flood premiums are going to look like. If you are under contract to buy a property right now, or are looking to buy a property soon, you definitely want to research with an insurance agent to see what the new flood rate will be. If it is possible to assume the seller’s existing flood policy, that is probably your best bet for now, but know that the rate may be going up 18% per year. The bottom line is that flood insurance rates have been remarkably low for a long time, and they were always going to go up in some form or fashion in order to sustain the National Flood Insurance Program. I am very interested to see how it all shakes out and how everyone’s rates are individually affected. Please keep me posted and I will do my best to keep you posted on any developments!!